south san francisco sales tax rate 2020

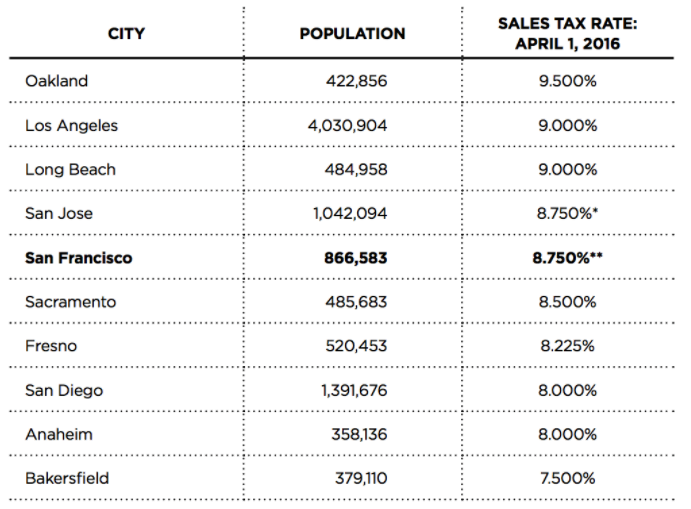

The average sales tax rate in California is 8551 The Sales tax rates may differ depending on the type of purchase. With local taxes the total sales tax rate is between 7250 and 10500.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

A City county and municipal rates vary.

. The state sales tax rate in California is 7250. Posted on 72321 Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2020 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are. Presidio of Monterey Monterey 9250.

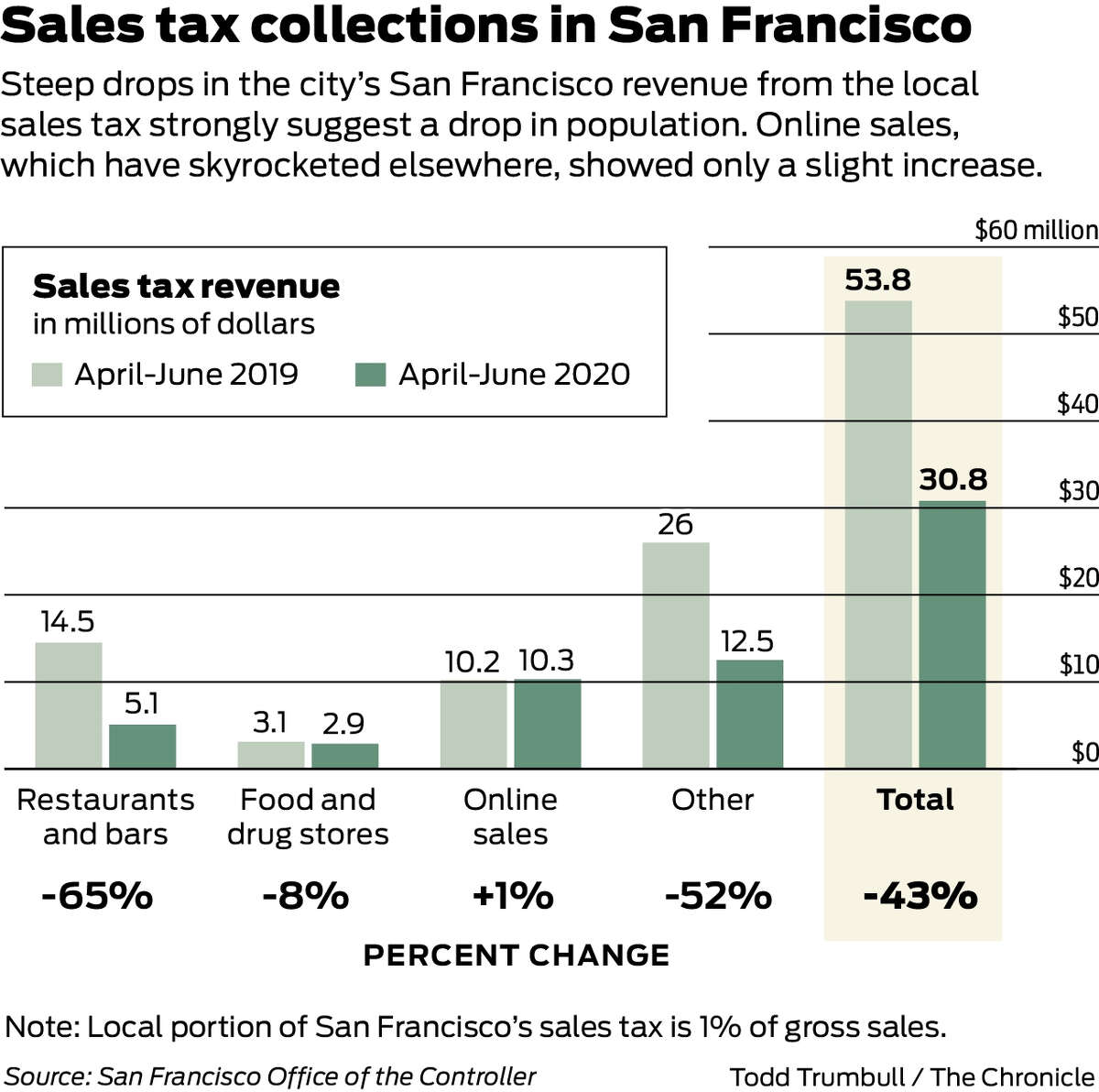

The San Francisco sales tax rate is 0. Did South Dakota v. Gross receipts tax gr proposition f was approved by san francisco voters on november 2 2020 and became effective january 1 2021.

This is the total of state county and city sales tax rates. In San Francisco the tax rate will rise from 85 to 8625. The County sales tax rate is 025.

A yes vote was a vote in favor of increasing the local hotel tax incrementally from 10 percent to 14 percent in 2021 with funds used for general city purposes. The current Transient Occupancy Tax rate is 14. The California sales tax rate is currently.

Rates Effective 04012020 through 06302020 Note. Higher sales tax than 89 of California localities -0375 lower than the maximum sales tax in CA The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. B Three states levy mandatory statewide local add-on sales taxes at the state level.

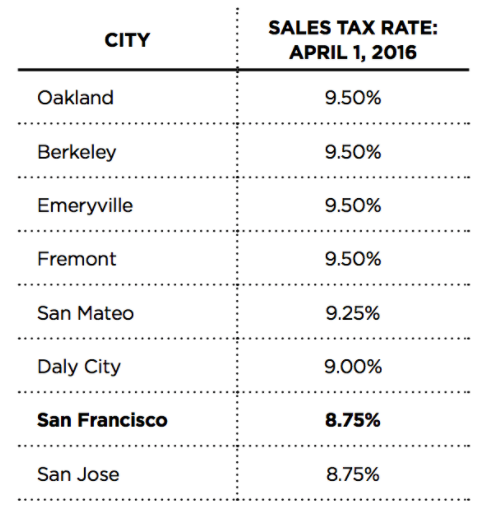

To calculate the amount of sales tax to charge in San Francisco use this simple formula. Sales tax total amount of sale x sales tax rate in this case 85. City Total Sales Tax Rate San Francisco 8500 San Jose 9250 Santa Ana 9250 Santa Clarita 9500.

The County sales tax rate is. California 1 Utah 125 and Virginia 1. California CA Sales Tax Rates by City.

The December 2020 total local sales tax rate was 8500. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. If you received a letter from our office instructing you to file please file regardless of the criteria listed below.

Tax returns are required monthly for all hotels and motels operating in the city. This is the total of state county and city sales tax rates. South Shore Alameda 10750.

The new rates will be displayed on July 1 2021. You can print a 9875 sales tax table here. The minimum combined 2022 sales tax rate for South San Francisco California is.

How to calculate San Francisco sales tax. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. San Francisco is in the following zip codes.

Most of these tax changes were approved by voters in the November 2020. State Local Sales Tax Rates As of January 1 2020. The County sales tax rate is.

The 94112 San Francisco California general sales tax rate is 85. These rates are weighted by population to compute an average local tax rate. Next to city indicates incorporated city City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles.

There is no applicable city tax. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. San Francisco CA Sales Tax Rate San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco CA is 8625.

The California sales tax rate is currently. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. Wayfair Inc affect California.

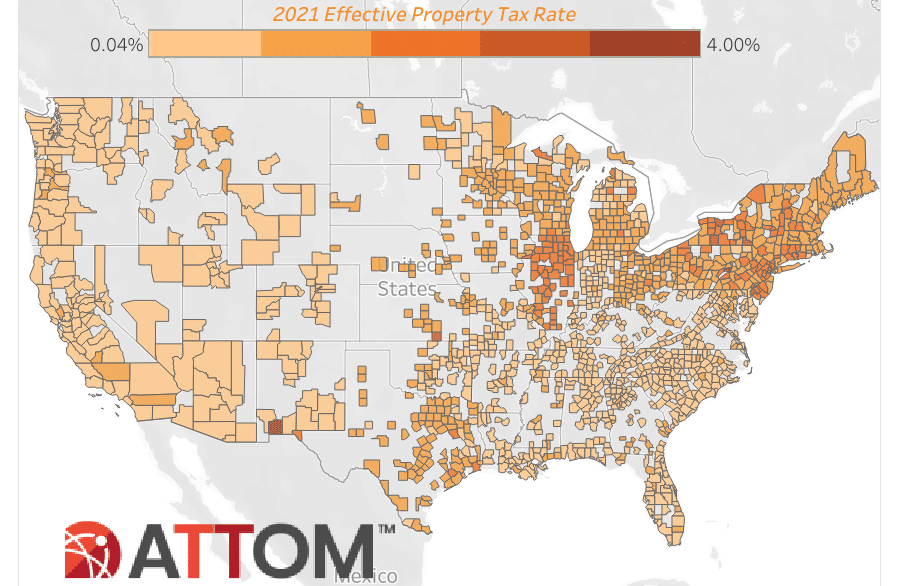

The minimum combined 2022 sales tax rate for San Francisco California is. 22 Methodology Sales Tax Clearinghouse publishes quarterly sales tax data at the state county and city levels by ZIP code. The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200.

A yes vote supported authorizing a sales tax increase from 05 to 075 generating an estimated 11 million per year for municipal purposes including street maintenance infrastructure local businesses public Wi-Fi and debt reduction thereby increasing the total sales tax rate in San Fernando from 10 to 1025. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. 1788 rows California City County Sales Use Tax Rates effective April 1 2022.

The San Francisco sales tax rate is. The South San Francisco sales tax rate is. What is the sales tax rate in San Francisco California.

Did South Dakota v. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. This base is far wider than the national median where the sales tax applies to 3425 percent of personal income.

The California sales tax rate is currently 6. South San Francisco Sales Tax Rate 2021. South San Francisco collects a 0 local sales tax the maximum local sales tax allowed under California law South San Francisco has a lower sales tax than 851 of Californias other cities and counties South San Francisco California Sales Tax Exemptions.

Sales Tax Breakdown San Francisco Details San Francisco CA is in San Francisco County. The current Conference Center Tax is 250 per room night. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

South San Francisco 9875. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing.

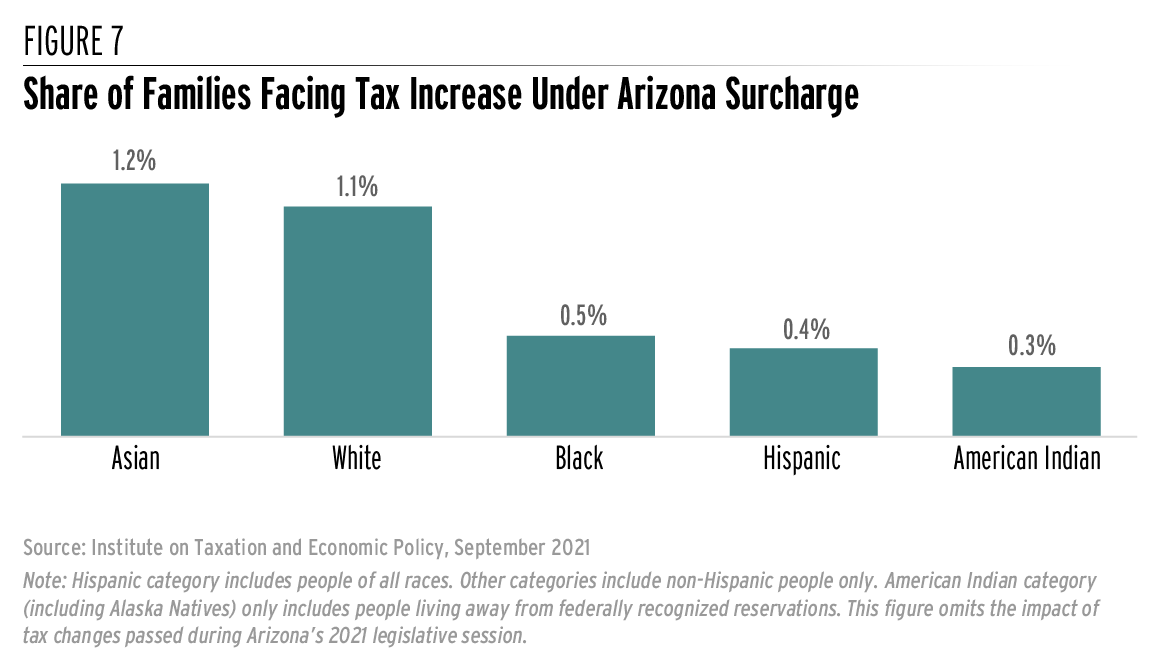

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Amazon Had Sales Income Of 44bn In Europe In 2020 But Paid No Corporation Tax Amazon The Guardian

California Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

California Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar

Frequently Asked Questions City Of Redwood City

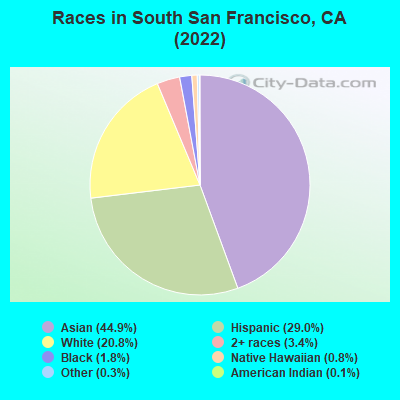

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Do State And Local Sales Taxes Work Tax Policy Center

San Francisco Bay Area Apartment Rental Report Managecasa

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Expected Tax Increases Have Bay Area Wealthy Moving With Urgency San Francisco Business Times

States With Highest And Lowest Sales Tax Rates

Food And Sales Tax 2020 In California Heather

What Are California S Income Tax Brackets Rjs Law Tax Attorney

States With Highest And Lowest Sales Tax Rates

I Overview In Tax Harmonization In The European Community

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline